Student loan | New law will allow for <b>student loan</b> debt re-fi | WTNH Connecticut <b>...</b> |

| New law will allow for <b>student loan</b> debt re-fi | WTNH Connecticut <b>...</b> Posted: 04 Sep 2015 01:04 PM PDT

The annual migration of thousands of students back to Connecticut college campuses has pretty much concluded. Whether looking forward to their final year or the first, one of the things many have in common is anxiety about payments they'll have to make for years to pay off their student loans. For over thirty years, the State of Connecticut has offered student loan help through the 'Connecticut Higher Education Supplemental Loan Authority,' known as CHESLA. The current rate is 4.95 percent. Today, the Governor signed a law that will make CHESLA's low interest rates available to those who have graduated, but are stuck with high payments. "A key component of the act is that it gives us the ability to do refinancing of existing student debt. We hope to have it available in the spring of 2016," said Jeantte Weldon, the Executive Director of CHESLA. "When I look out at my peers, people my age, people younger, they are unable to start new businesses, they are unable to buy houses and in some cases are unable to start families," said State Representative Matt Lesser (D-Middletown), who helped to write the new law. The Governor went to the campus of the University of St. Joseph today where the new university President, Rhonda Free, was praising the move. "For people who are thinking of going to college this reduces their anticipated costs with lowered interest rates. I think it also reassures some students and their parents," said Free. What's reassuring for parents and students is a second law that will give the state Banking Commissioner jurisdiction over private student loan institutions. After signing the bill into law, Gov. Malloy said it will be, "Providing new protections for individuals in repaying their debts and making sure that our citizens are being treated fairly by properly run institutions." Click here for more information on the Connecticut Higher Education Supplemental Loan Authority. WTNH NEWS8 provides commenting to allow for constructive discussion on the stories we cover. In order to comment here, you acknowledge you have read and agreed to our Terms of Service. Commenters who violate these terms, including use of vulgar language or racial slurs, will be banned. Please be respectful of the opinions of others. If you see an inappropriate comment, please flag it for our moderators to review. |

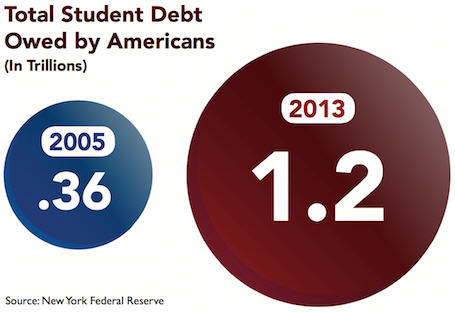

| Newly released SchiffGold White Paper: The <b>student loan</b> bubble <b>...</b> Posted: 03 Sep 2015 01:58 AM PDT "You need a college degree to succeed in America." This idea has become so commonplace that the right to higher education is now a core issue in most political platforms. What if a young person cannot afford a college degree? The "obvious" answer from politicians on both sides of the aisle is that the government should subsidize them. Very few are brave enough to ask the far more important question: "At what cost?" The answer is simple: as of today, the cost is $1.2 trillion. That is the current level of student loan debt in the United States, which represents the second largest category of consumer debt after home mortgages. It has grown by leaps and bounds since the financial crisis of 2008 and now surpasses even car loans and credit card debt. The American Dream used to be simple: the ability to shape one's own destiny and wealth without interference from the king, the government, or other powerful interests – the right to "life, liberty, and property." Over generations, this dream has been coopted by politicians and bankers to gather votes and riches. In the 20th century, the idea of owning a home became an integral part of the Dream, which led to the disastrous idea that even unqualified borrowers deserve the opportunity to buy a house. We are all familiar with the fallout – the subprime mortgage crisis and ultimately the Great Recession. Today, ten years later, politicians are now claiming that a college education is part of the American Dream and also a right of all Americans – regardless of their credit rating and SAT scores. Spurred on by even lower interest rates and the implicit promise that John Q. Taxpayer will once again come to the rescue should anyone happen to default, we now have a growing student loan bubble on our hands. Since 2003, student loan debt has more than quadrupled – rising from $250 billion to well over $1 trillion. It has increased over $500 billion (a 75% increase) since the beginning of President Obama's first term, when it sat at $660 billion. Furthermore, at the end of 2008, the default rate was 7.9%, but now stands at 11.3% – a huge increase that is most assuredly an underestimation. Perhaps the most alarming element of this trend is that there is no collateral required for a student loan. Banks can foreclose and repossess the house when a borrower defaults on a home loan. However, what can a bank repossess in the case of a student loan? A diploma? Knowledge? The bottom line is that each dollar of a defaulted student loan will pack much more of an economic punch. And don't assume for a minute that the students themselves will escape unscathed. Student debt cannot be expunged through bankruptcy. The federal government can garnish up to 15% of gross income for 25 years from defaulters. Some might say, "What's the big deal? America has already been dealing with massive amounts of debt. Is this really going to make that much of a difference?" The big deal is that the student loan bubble adds significantly to the nation's large debt burden, which at 102% of GDP is clearly unsustainable and doomed to inevitably lead to an economic collapse. What's more, the current figure of $1.2 trillion is just today's student debt load. This is expected to nearly triple in the next ten years. Every investor needs to understand how the student debt bubble will impact the US markets. In a newly released white paper, SchiffGold explains how best to prepare for a financial collapse that will dwarf the 2008 financial crisis. Download this exclusive SchiffGold White Paper for free today: The Student Loan Bubble: Gambling with America's Future. Addison Quale is a Precious Metals Specialist with SchiffGold. He studied economics at Harvard University and earned a Master of Divinity at Gordon-Conwell Theological Seminary. Addison brings a well-rounded perspective to precious metals investing, with work experience at an investment consulting firm in Boston. Link to the original source here. |

| You are subscribed to email updates from student loan - Google Blog Search To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment